PROVEN AND INNOVATIVE MARINE SOLUTIONS FOR THE OFFSHORE RENEWABLE ENERGY INDUSTRY

Current priorities for the offshore renewable energy industry include minimising costs, installing larger turbines in deeper water, and safeguarding the environment. Acteon drives down costs for operators by optimising design and installation activities and improving scheduling and resource utilisation. Alongside our extensive track-record within the fixed renewables industry, we have the expertise to support the development of large structures in deep water, including floating installations. And provide baseline environmental surveys so that projects can establish appropriate controls for environmental protection.

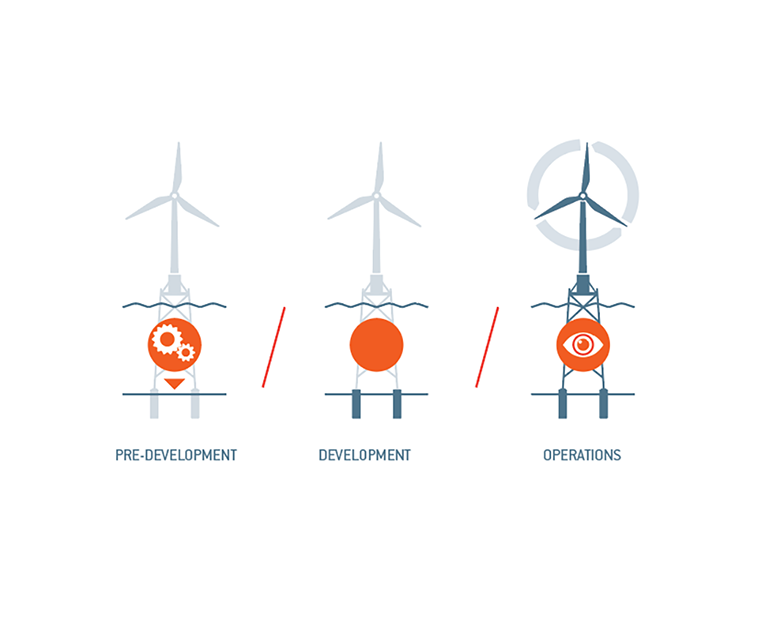

ORGANISED ACROSS ALL PHASES OF THE PROJECT LIFE CYCLE

Our engineering solutions and factory approach to construction and installation help to optimise capital and operating expenditure for a lower life-cycle LCoE. Whether projects are for foundations, towing and mooring, or cable configuration, our ability to work from the engineering phase all the way to logistics and installation enables us to bring significant economies of scale and cost efficiencies to the most complex projects.

Which type of project do you need help with?

Drive down the costs of wind farm installation

Acteon’s integrated engineering solutions optimise capital and operating expenditure to lower the life-cycle levellised cost of energy (LCOE) for wind farms. We can optimise designs and identify potential issues from the start of a project. Our design and engineering services deliver complete project solutions that our engineers can implement.

We propose creative, fit-for-purpose geo-services and installation solutions that do not depend on using a particular vessel for all aspects of the work. This enables cost savings and shortens project delivery schedules.

Our domain experts apply standardisation and integration processes that optimise scheduling and resource utilisation while reducing project risks.

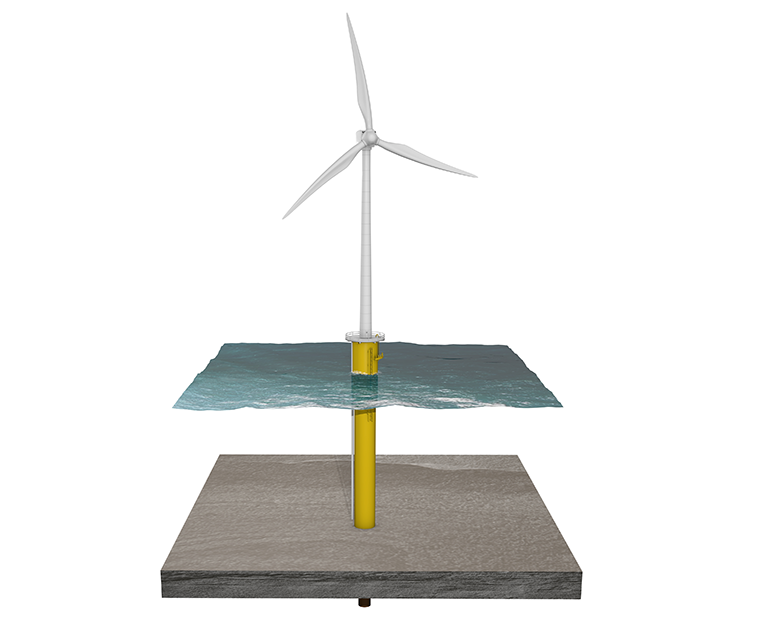

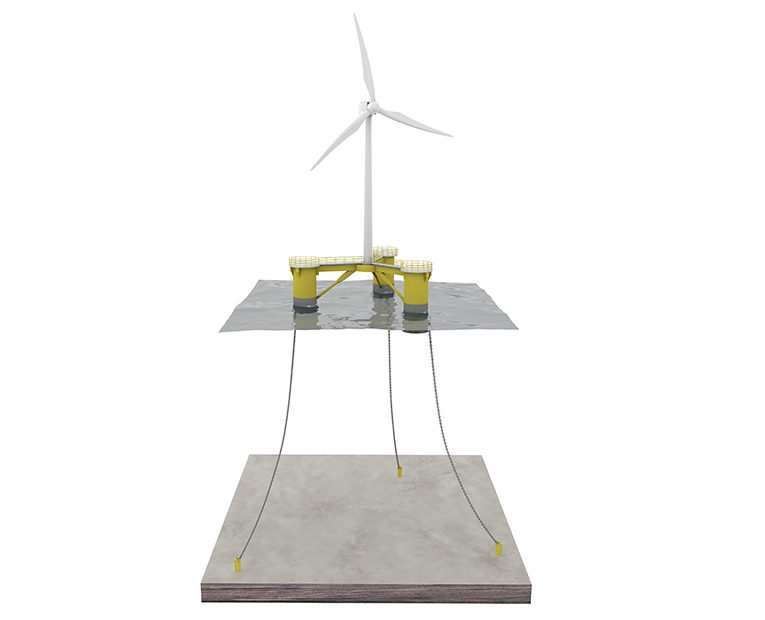

Install larger turbines in deeper water

Acteon offers drilling services for piles in excess of 10 m in diameter. Our solutions include hydraulic piledriving equipment and hammers that are the most powerful on the market. Their modular design enables easy transportation, assembly, and maintenance. We are developing equipment to install the new series of XXL monopiles.

For floating turbines, we provide a single interface and a holistic approach for equipment and services, from front-end engineering design (FEED) to mooring services and other marine operations that cover everything from quayside operations to towing, offshore mooring and cable laying.

Minimise Environmental Impact

We understand the importance of minimising environmental impacts during the installation process.

We offer a wide range of surveys that help customers to establish baseline levels of marine flora and fauna and water quality, salinity and heavy metal and other key component levels. The results from these surveys can be used to establish appropriate project controls that protect the environment from the start of a project.

Noise mitigation is an important factor in offshore construction and legislation varies from region to region. Our piledriving solutions feature industry-leading noise mitigation technology to minimise the effects of construction noise on marine ecosystems.

Acteon’s integrated engineering solutions optimise capital and operating expenditure to lower the life-cycle levellised cost of energy (LCOE) for wind farms.

Acteon's renewable energy solutions brochure

Through early engagement and a unique point of contact, we can significantly reduce the total cost of construction and installation of subsea infrastructure, safely and responsibly. Gain access to exclusive content for complete renewable energy solutions.

Contact the team

Acteon provides specialist engineering, services and technology to companies who develop and own marine infrastructure across the life of their assets. We enable our customers to achieve their operational goals with a more efficient integrated solution: reducing the cost and carbon footprint through value engineering without compromising the quality of delivery. Get in touch today to find out more.

Case Studies

A selection of our successful projects within the renewable sector