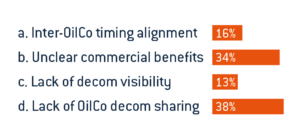

We asked: What do you think is the main reason preventing multi-operator campaigns on the UKCS?

What does this mean?

It is apparent that there is a lack of sharing decommissioning plans between operators, but what is the main reason for this? Operators seem to be focused on their own campaigns and goals and undertaking these via traditional tendering activity rather than collaborating with others who have similar requirements.

Sharing of information between operators is already happening in the Netherlands with Nexstep and it is looking promising in the East of Shetland with CNR, EnQuest, TAQA and Total signing a charter reinforcing their commitment to collaborating for decommissioning in that basin. This charter could be the start of things to come within the UKCS with the supply chain ready and waiting to bring their knowledge and services to such opportunities and make decommissioning the reality rather than a vision.

With Acteons’ proven history in providing multi-operator campaigns for well abandonment we can demonstrate the commercial benefits to our clients, this is achieved by sharing the fixed costs of doing business offshore such as equipment preparation, vessel delivery fees and mobilisation costs.

With cost reduction playing a huge part in the decommissioning sector, campaigning makes more sense than ever.

Pressure from the regulators is also of paramount importance to ensure the operators move forward and are provide visibility on their plans but more needs to be done.

Lack of oil company decommissioning sharing of information means that operators are trying to solve the problem themselves within their own community rather than looking to the supply chain. The OGA are committed to change this trend and it will be interesting to see how this develops.

SUSPENDED SUBSEA E&A CAMPAIGNS

The OGA are encouraging operators to execute suspended subsea E&A well abandonment as part of a campaign.

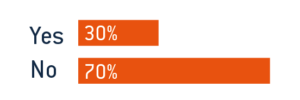

We asked: Do you think this is going to be a reality in 2022/23?

What does this mean?

The results of this poll demonstrate the lack of optimism within the supply chain for future opportunity; this could be down to various factors such as previous delays in decommissioning contracts, the recent downturn in the oil and gas market and even the impact of COVID.

There is visibility on the suspended subsea E&A wells that require abandonment, however, this may not happen in the predicted time scale due to operator budget cuts. The overall decrease in expenditure and restrictions offshore has meant more pressure on the supply chain who may have still been recovering from the downturn. This has however given the supply chain the opportunity to innovate and develop technology to help streamline projects and keep mobilisations and persons on board (POB) to a minimum whilst encouraging multi-operator campaigns. For example, Acteon’s focus is to reduce the cost, complexity and time to safely remove offshore infrastructure and we use abrasive technology to save rig and vessel time and apply technology to improve reliability through well sealing, laser cutting and cut verification. There needs to be a shift in culture from the way oil and gas projects have been done in the past.

Does delaying decommissioning scopes point to the hope that costs will be reduced if postponed by 10 or even 20 years? In the meantime, the supply chain may turn their focus to the renewables sector whilst keeping the future decommissioning projects on the backburner. This could lead to assets being deployed to other regions, personnel being upskilled to work in other energy sectors and could therefore result in increased costs in the future for skills and knowledge and assets to be brought back into the UKCS. A good example of this is in Southern California where there are currently 23 oil and gas platforms requiring decommissioning, but with the supply chain having moved out of region this is going to prove costly for assets to return to conduct the decommissioning scopes. So, overall, delaying decommissioning may not guarantee reduced costs. Looking at acting sooner rather than later and optimising projects through a joined-up campaign approach and the new technology available through the supply chain could prove much more cost effective.

CAMPAIGNING OF SUBSEA INFRASTRUCTURE

With Acteon’s proven track record in multi-operator well abandonment, we firmly believe that the campaigning approach can also be effectively applied for subsea infrastructure removal.

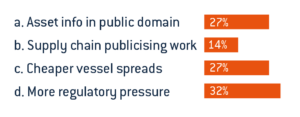

We asked: Would campaigning of subsea infrastructure be easier with…

Our audience said:

“All possible if DPs approved and scopes agreed/planned in advance.”

What does this mean?

Our results show quite an equal share of votes over three of the statements that we asked.

Cheaper vessel spreads

To reduce costs for decommissioning it is essential that the type of vessels considered to undertake the work is not necessarily the same as what is used for installation. The UKCS has an abundance of high spec installation vessels that unfortunately come with an expensive day rate. Acteons’ differentiator is that we focus on the right technical solutions and deploy these solutions from a vessel that is at the optimal price point for decommissioning. Rather than having a limited number of vessels in our internal fleet, Acteon have no in-house vessels at all. This gives us the ability to select a multitude of vessel types from the under-utilised global offshore fleet. Furthermore, we can consider alternative vessels which can reduce costs significantly and provide sustainable solutions by integrating our ‘smart thinking’ with them. Acteon further optimised projects by offering a single point of contact to drive project efficiency; retain the knowledge through the cycle and ensure the highest quality of delivery.

More regulatory pressure

‘More regulatory pressure’ received 32% of the votes, which indicates that there is a belief that there is not enough being done by regulators. They hold the power to ensure retired assets are removed in a timely manner. OPRED is responsible for approving, regulating and monitoring the execution of decommissioning programmes in the UK but what more could the regulators do to push the operators? Perhaps putting more pressure on the operators to share information with the supply chain is the answer.

SOLUTIONS TO ENCOURAGE CAMPAIGNING

Acteon aims to simplify the campaign approach to decommissioning and make it easily accessible to operators. We lead the development, promotion and execution of our integrated offerings by coordinating and project-managing significant scopes of work of varying size and/or complexity across or within the decommissioning arena. Acteon can offer, and package it in a way that generates value for all involved through attractive commercial models. These solutions connect skills, technologies, products and services and are delivered through a single point of contact under a single contract.

The full SWAT™ suspended well abandonment tool campaign from Acteon opens the opportunity for innovative, cost-saving multi-operator campaigns, including vessel provision.

Acteon can manage and execute multi-client campaigns based on decommissioning-by-task rather than individual field or client. This includes using SWAT™ a key component along with subsea infrastructure removal.

Take a look at some of our projects.

Contact us to discuss how we could manage and deliver your decommissioning campaign.